Child Tax Credit 2024 Phase Out Limit – Child Tax Credit 2024 Income Limits: A substantial federal tax benefit, the child tax credit is intended to provide financial assistance to American taxpayers who are in the process of rearing . However, exceeding the specified income limits will result in a reduction of the credit amount. Taxpayers can claim the child tax credit when filing their tax returns in 2024, emphasizing the .

Child Tax Credit 2024 Phase Out Limit

Source : itep.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

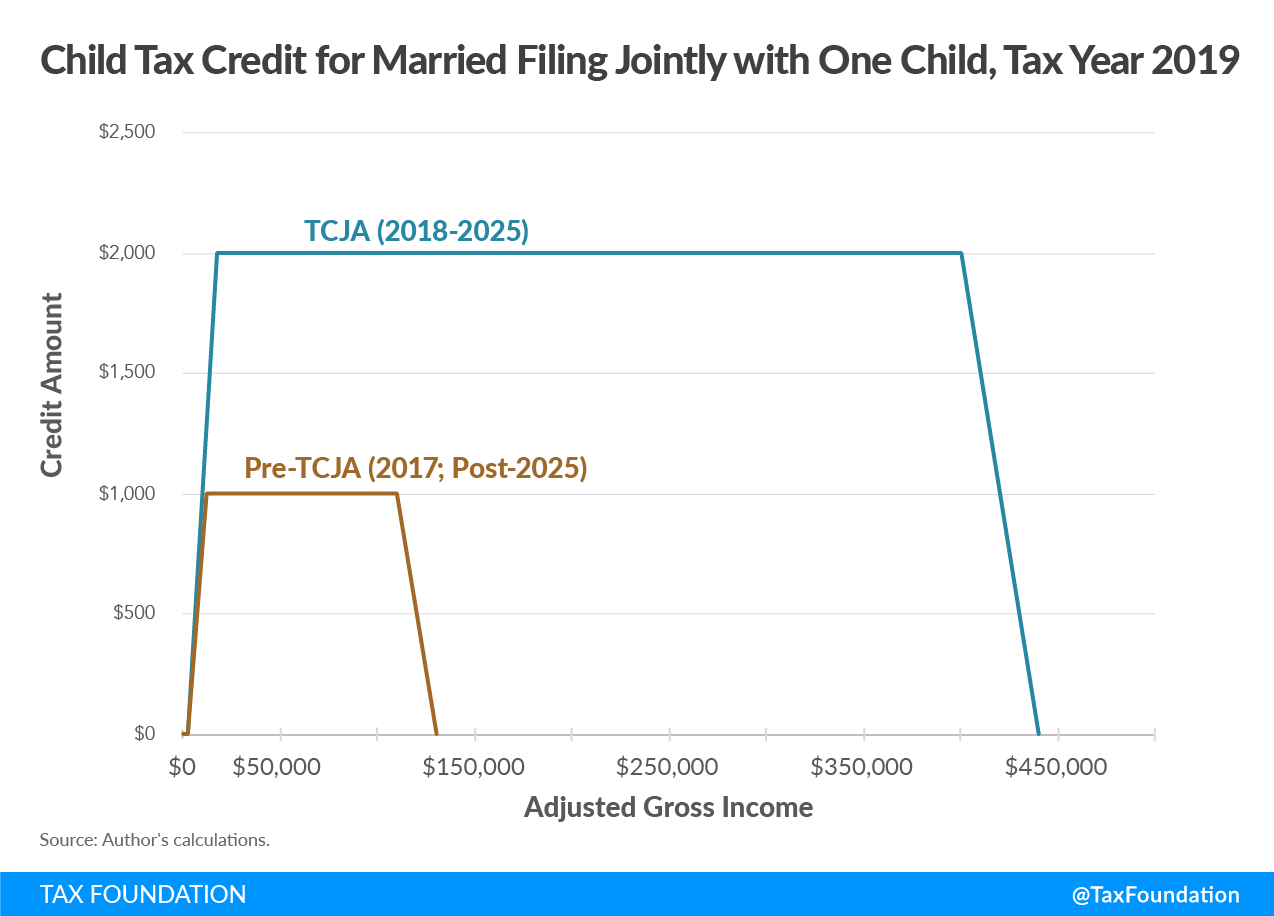

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024: Eligibility Criteria, Apply Online, Monthly

Source : ncblpc.org

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Child Tax Credit 2024 Phase Out Limit States are Boosting Economic Security with Child Tax Credits in : While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. . If you have any children the limit. For example, a MAGI of $210,000 as an individual would allow you to claim $1,500 for each eligible child. The child tax credit is phased out completely .