Child Tax Credit 2024 Qualifications Form – Here’s how much the child tax credit is for 2024, and why you might want to wait to file your tax return this year. . People filing in 2024 are filing for the year 2023. The Child Tax Credit offers support to as many as 48 million applying American adults who need an extra bit of help with raising their children so .

Child Tax Credit 2024 Qualifications Form

Source : www.kvguruji.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

American Opportunity Tax Credit (AOTC): Definition and Benefits

Source : www.investopedia.com

Child Tax Credit 2024 Requirements: Are there new requirements to

Source : www.marca.com

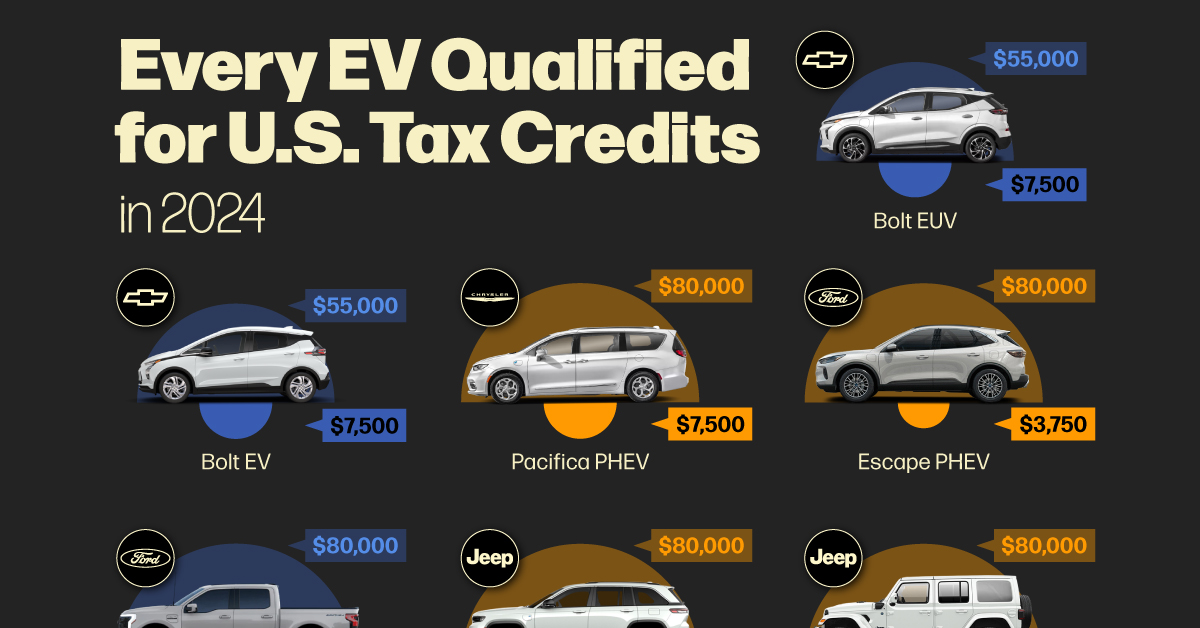

Every EV Qualified for U.S. Tax Credits in 2024

Source : www.visualcapitalist.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Every EV Qualified for U.S. Tax Credits in 2024

Source : www.visualcapitalist.com

Child Tax Credit 2024 Qualifications Form IRS Child Tax Credit 2024: Credit Amount, Payment Schedule, Tax Return: Had or adopted a child in 2023? What new parents need to know about tax credits and deductions. Importantly, the enhanced Child Tax Credit went away in 2022. . With all the forms credit), you may receive up to $1,600 per qualifying child. There are several requirements to qualify. The first is you must be a parent or guardian who is filing taxes in 2024. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)

:max_bytes(150000):strip_icc()/Screenshot2023-03-30at1.06.15PM-4cd9ea80b5724ecb94d8cbc88fae95da.png)